Uruguay playing card tax

In 1806 the Council of Concepción del Uruguay imposed an 8 Peso tax on card and billiard tables on account of “the detrimental effect on poor and innocent people”

Uruguay playing card tax - Impuesto Sobre Naipes

In 1806 the Council of Concepción del Uruguay imposed an 8 Peso tax on card and billiard tables on account of "the detrimental effect on poor and innocent people". During the 19th century various import tariffs were applied to playing cards. After February 1919 tax on playing cards was controlled by tax stamps on the cards and tax bands outside the wrappers, according to the following laws:

Leyes Nros. 6,874 y 6,894 de 11 & 27 de Febrero de 1919.

A) Impuesto sobre barajas de producción nacional = 12 centésimos [blue tax stamp]

B) Impuesto sobre barajas de importación = 22 centésimos [yellow tax stamp]

Ley Nº 11,326, Montevideo, 7 de setiembre de 1949.

Artículo 12. El impuesto interno a los naipes, establecido por las leyes Nros. 6.874 y 6.894, de 11 y 27 de febrero de 1919, será percibido de acuerdo a la siguiente escala:

A) Naipes nacionales: cada mazo = $ 0.25

B) Naipes importados: cada mazo = $ 0.60

Los naipes importados que se vendan al público a un precio superior a $ 1.50 pagarán el impuesto a razón de $ 0.25 por cada $ 0.50 o fracción del precio de venta.

El Poder Ejecutivo reglamentará la forma de percepción y controlar de este impuesto. Vigente hasta noviembre do 1960.

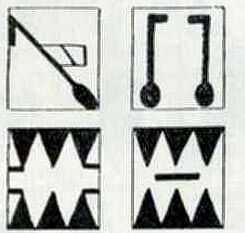

Above: tax stamps for home-produced cards for the period 1949-1960.

The tax band shown below corresponds to Law Nº 12,804 of 30 November 1960 and has been overprinted with text relating to home-produced playing cards in Uruguay. The Law states that 38% of the revenues from the tax on playing cards shall be allocated to the Pensions Fund.

Above: The Sale Price is overprinted on the taxband as $280, whilst the tax paid is $84, which is 30% of the sale price. It appears that only 38% of this tax was paid into the Pensions Fund, i.e. $32.

The above tax law was temporarily superseded in 1967 by Ley Nº 13,637 which ruled that the tax on nationally-produced playing cards was $10.00 (ten pesos) per pack and 20% of the sale price. This was raised to 30% in 1968 by Ley Nº 13,695. After this period the law reverted to the 1960 tariff until 1974, when it ended.

Information on Uruguayan playing card taxes available from www.parlamento.gub.uy.

Further information about tax stamps on playing cards at

Taxes and Tax Stamps on Playing-cards.

By Simon Wintle

Member since February 01, 1996

Founder and editor of the World of Playing Cards since 1996. He is a former committee member of the IPCS and was graphics editor of The Playing-Card journal for many years. He has lived at various times in Chile, England and Wales and is currently living in Extremadura, Spain. Simon's first limited edition pack of playing cards was a replica of a seventeenth century traditional English pack, which he produced from woodblocks and stencils.

Trending Articles

Popular articles from the past 28 days

Related Articles

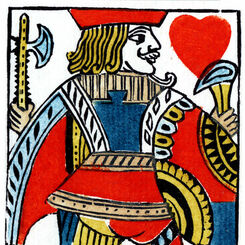

Woodblock and Stencil King of Diamonds

A limited edition art print of the King of Diamonds 1984 woodblock joker.

Woodblock and Stencil Jack of Clubs

A limited edition art print of the Jack of Clubs 1984 woodblock joker.

Woodblock and Stencil Jack of Hearts

A limited edition art print of the Jack of Hearts 1984 woodblock joker.

Woodblock and Stencil Joker

A limited edition art print of the 1984 woodblock joker.

73: Fakes, Forgeries and Tax Evasion

When there are official taxes to pay, people will find a way to avoid paying them - often illegally....

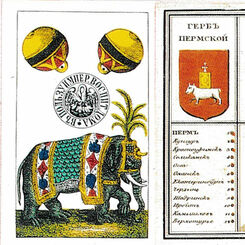

Russian Playing Card History - From the Beginnings to 1917

An in-depth review of the history of card-playing, gambling, legislation, manufacture and taxation o...

Russian Playing Card Monopoly

The Russian Playing Card Monopoly was established in March 1798 with all revenue going to support th...

72: The Ace of Spades

In standard English packs the Ace of Spades is associated with decorative designs. This is a histori...

Parisian style Spanish deck by Grimaud

Parisian style Spanish deck by Grimaud for export to Uruguay.

66: Adverts and related material 1862-1900

Some further material relating to cards from nineteenth and twentieth century periodicals.

Naipes ‘La Criolla’ by Anabella Corsi

Inspired by an archaic Spanish pattern formerly used in Spain during the 16th and 17th centuries.

Naipes ‘Charabon’

Naipes ‘Charabon’ - depicting the Gaucho as a national hero, Montevideo, 1983.

Naipes Artiguistas, 1816

Naipes Artiguistas published in Concepción del Uruguay, Entre Rios province (Argentina) in 1816, by ...

Playing Cards designed by Alvaros

Playing Cards designed by Alvaros, published by Eduardo Carrión, Montevideo, 2000

Club Nacional de Football, Uruguay

100th anniversary of the Club Nacional de Football, Uruguay, 1999.

Canasta

Canasta is a card game of the Rummy family which originated in Uruguay probably about 1947

Australian Excise Duty

Excise Duty was introduced on Australian playing cards in 1932

Taxation on Spanish Playing Cards

Taxation on Spanish Playing Cards.

Copa de Oro 1980

Naipes “Copa de Oro 1980” manufactured by Compañía General de Fósforos Montevideana, 1980.

Naipes Victoria

Victoria playing cards manufactured in Uruguay by Compañía General de Fósforos Montevideana, c.1955....

Supermercados CHIP

Supermercados CHIP playing cards manufactured in Uruguay by Compañía General de Fósforos Montevidean...

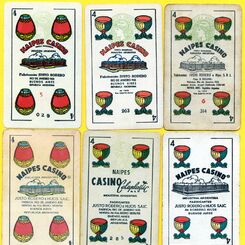

Cía Gral de Fósforos

Compañía General de Fósforos Montevideana, founded in 1893.

Naipes Victoria Gaucho

Naipes Victoria Spanish-suited, gaucho-themed pack celebrating the culture and traditions of the gau...

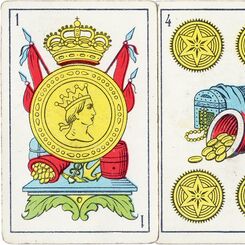

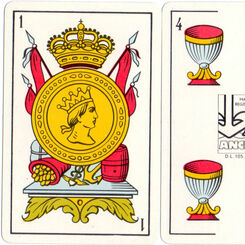

Fours of Cups

Over the years the company evolved, and changes in the company's name and address can be seen reflec...

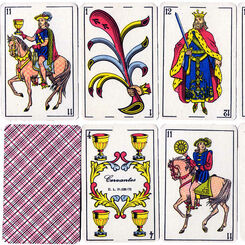

Naipes ‘Baccarat’

An example of the typical version of the Spanish Catalan pattern which is widely used in South Ameri...

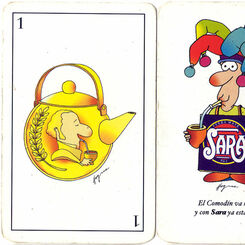

Las Cartas de Sara

Las Cartas de Sara (Yerba Mate) based on an idea by Diego Silva Pintos and illustrated by Hogue. Pro...

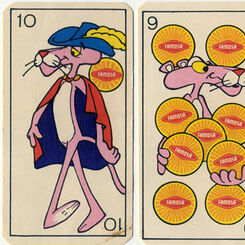

Chocolondo by Famosa

Chocolondo Waffle deck for Famosa.

Pilsen Trucofest

Pilsen Trucofest playing cards, Uruguay.

Uruguayan Playing Cards

Until the 19th century playing cards were imported into Uruguay from Spain.

Naipes ‘Ancla’

Naipes opacos ‘Ancla’ manufactured by Cía General de Fósforos Montevideana S.A. c.1980.

Naipes ‘Tito’, Camilloni Hnos

Naipes ‘Tito’, Camilloni Hnos, Montevideo, c.1950.

Naipes ‘Miguelito’

The standard Spanish-suited 'Parisian' style (Tipo Frances) is based on models exported to South Ame...

Naipes ‘El Gaucho’ by Cervantes S.A., Montevideo, c.1970s

Naipes ‘El Gaucho’ manufactured and distributed by Cervantes S.A., Montevideo, c.1970s.

Impuestos Internos Sobre Naipes

Duty was first introduced on playing cards in Argentina in 1892, as part of the Internal Duties law,...

Argenar, Buenos Aires, c.1980

The reverse has advertising for Cymaco motor spares who have branches in Uruguay.

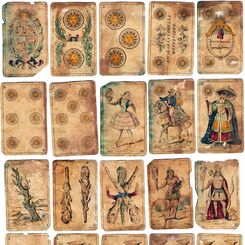

Native Indian Hand-made Cards made on rawhide

Native Indian hand-made cards made on rawhide.

Latin American Playing Cards

Playing cards had been introduced to the Americas with explorers such as Columbus or Cortés, whose f...

Las Cartas de Tacuabe by Manos del Uruguay

Tacuabé was a Charrúa native from Uruguay, an indigenous tribe that became extinct following Europea...

Escalada y Vidiella, Montevideo c.1860

Cards from a 40-card pack made in Belgium by Antoine van Genechten exclusively for the firm "Escalad...

Uruguay playing card tax

In 1806 the Council of Concepción del Uruguay imposed an 8 Peso tax on card and billiard tables on a...

Naipes Tatú

Naipes Tatú, M.C. de Casabó S.A., Montevideo, c.1956

Naipes “El Gaucho”, c.1955-60

Naipes “El Gaucho” Manufactured by Gráficos Unidos S.A., Montevideo, c.1955-60

Naipes ‘Retruco’

Naipes ‘Retruco’ published by Fantasias S.A., Montevideo, c.1980.

The ‘Parisian’ Spanish pattern

A version of the old Spanish National pattern which was manufactured by Parisian card makers in the ...